Why Southeast Asia needs digital financial literacy education

Nadia Maunsell

Nadia Maunsell

There is a pressing need for digital financial education in Southeast Asia, given its profound implications for individual welfare and regional economic development.

In many ways, the money sent home by migrant workers forms the backbone of Asia’s inbound investments. Remittances to East and Southeast Asia totalled $133 billion in 2023, which included $40 billion to the Philippines alone. Excluding China, remittances surpassed foreign direct investment (FDI) flows and became the single-largest private source of external financing to the region. Even during the pandemic-induced economic crisis, remittance flows defied World Bank predictions and remained high.

However, from a migrant’s perspective, the picture is significantly less rosy.

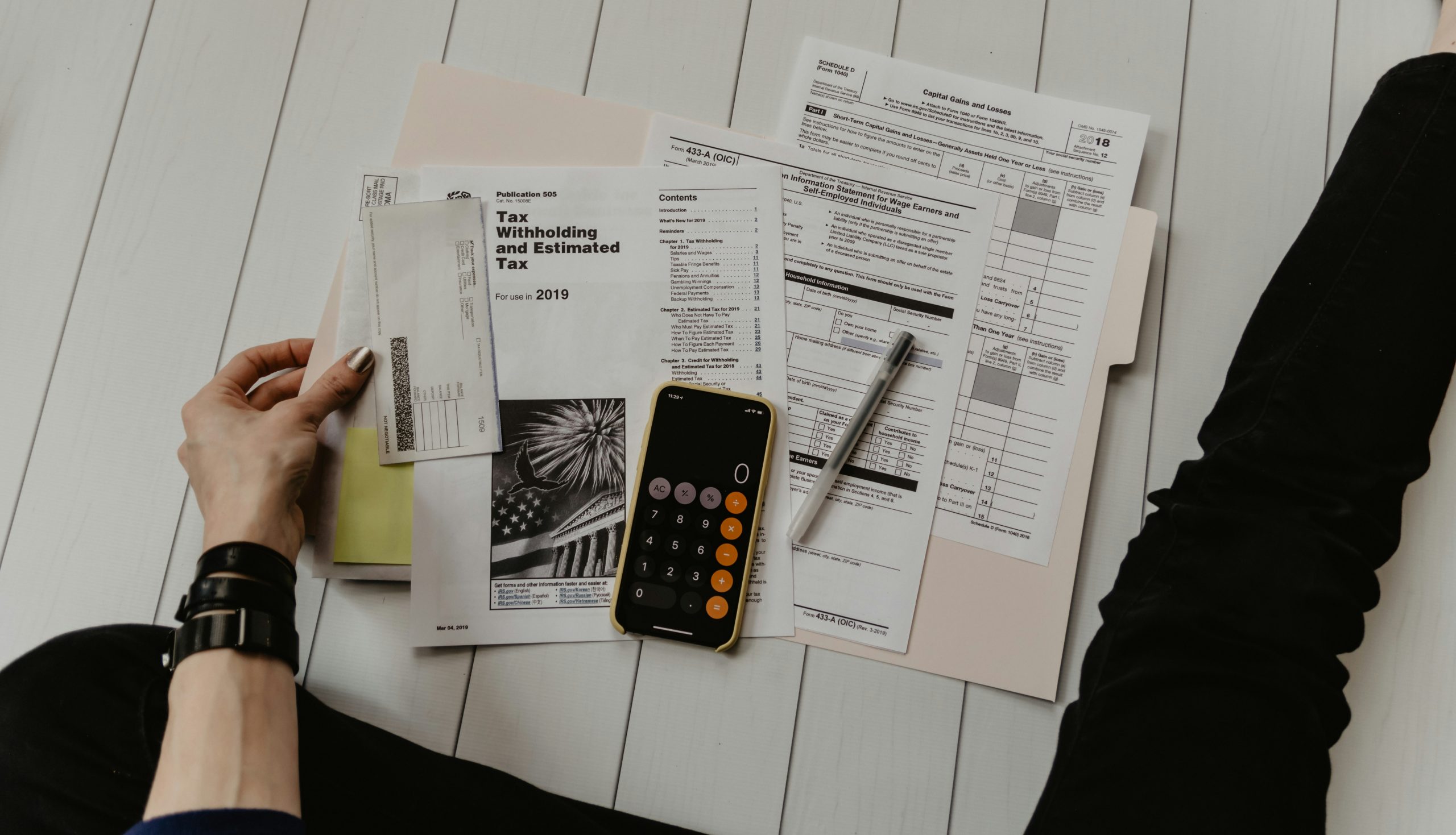

Just under half of all migrant workers in Southeast Asia take out a loan to cover the cost of migration. Debt has a serious impact on the lives of migrants and their families, often requiring people to work long overtime hours to pay back loans, accept undesirable working conditions, and ultimately limit their ability to remit home. On top of that, over 80 percent of remittances received at home are spent on the consumption of goods and services. This makes it more difficult for migrants and their families to save and invest in longer-term assets that will continue to sustain their livelihoods once they stop working.

This article briefly outlines three key aspects of digital financial literacy (DFL) education, emphasising how Southeast Asian migrants can take back control of their finances and save money with confidence.

Demand for digital financial literacy

Despite the global explosion of FinTechs designed to make finance more accessible, DFL has not kept pace. Southeast Asia in particular has experienced a boom in cross-border payments, e-commerce, and remittance platforms that impacts the lives of 265 million unbanked adults in the region. In direct response, ASEAN Member States have identified the need for DFL to give consumers the skills to make informed financial decisions and avoid underlying risks, such as fraud. A number of international development organisations, including the International Organisation for Migration, UN Capital Development Fund, and International Labour Organisation, have made similar calls for comprehensive DFL training for migrants in the region.

Channels for dissemination of digital financial literacy

Pre-departure and skills training are both features of Southeast Asian government policies to prepare migrants for life abroad, although they are not systematic nor standardised. In a positive first step, Cambodia’s Policy on Labour Migration explicitly lists migrants’ understanding of financial literacy as a key objective. In Viet Nam, mandatory pre-departure training is typically restricted to basic employment skills and foreign language learning, but there is ample room to include DFL education. This is because migrants need to know how to open a bank abroad, save money for the long-term, and send money home in safe and cost-effective ways. Employers can also promote this critical information during on-the-job training since they are required to pay workers into designated accounts.

Solving digital financial literacy

The SaverLearning app is our answer to financial inclusion in an increasingly digitalised region. Traditional DFL education has often been confined to the classroom but with the SaverLearning app, migrants can return to and utilise the financial tools, features, and rewards offered within the course portal at any time. The SaverLearning app can be accessed anywhere, and it offers a sleek, user-centred interface that customises financial literacy topics according to a migrant’s skill level. Best of all, it is entirely free to use.

Where to next?

The importance of DFL education will only increase as newer digital and financial technologies emerge in the future. This necessitates a concerted effort on the part of governments, international development organisations, and companies to equip individual migrants with the skills required to navigate and take control of their finances. Addressing the diverse needs of Southeast Asian populations also requires a multifaceted approach that leverages the strengths channels such as pre-departure and skills training.

Moving forward, it is essential to view DFL as a journey rather than a destination. Ongoing assessment, adaptation to evolving technologies, and an inclusive approach will be paramount for success. The future prosperity of Southeast Asian migrants will hinge on a digitally and financially literate population capable of navigating financial decisions with ease. Through SaverLearning’s collaborative efforts and our commitment to inclusive education, we are on a mission to pave the way for a financially capable region.

[1] World Bank. 2023. Remittance Flows Continue to Grow in 2023 Albeit at Slower Pace.

[2] World Bank. 2023. Leveraging Diaspora Finances

for Private Capital Mobilization.

[3] World Bank. 2020. World Bank Predicts Sharpest Decline of Remittances in Recent History.

[4] IOM ROAP. 2020. Remittance Inflow Trends Snapshots.

[5] IOM and ILO. 2017. Risks and rewards: Outcomes of labour migration in South-East Asia.

[6] UNDP. 2023. How the money flows: Six major trends for remittances.

[7] WEF. 2022. How to close Southeast Asia’s financial inclusion gap.

[8] AFI and ASEAN WC-FINC. 2021. Policy Note on Digital Financial Literacy for ASEAN.

[9] Kingdom of Cambodia. 2018. Policy on Labour Migration for Cambodia.

[10] Hong, Khuat Thu. 2021. Sending More or Sending Better Care

Workers Abroad? A Dilemma of Viet Nam’s

Labour Exporting Strategy.

This blog was written by Nadia Maunsell, Product Manager at saverglobal.com.

Cover image by Kelly Sikkema on Unsplash.

Nadia Maunsell

In her role as Product Manager, Nadia blends vision with execution and brings a wealth of international development and strategic communications experience to the saverglobal.com team.