Financial Education

SaverLearning

The SaverLearning platform is designed to translate traditional financial literacy courses and education into an evergreen, scalable format. We use the latest advancements in EdTech and machine learning to personalise the user experience so that financial education can be specific to the individual. Coupling this with interactive content and tools that put learning into practice, our capabilities extend far beyond the traditional model at a much lower cost.

Multiple languages

Learning systems that are designed for a global audience

Culturally relevant

Content that is specific to the user’s context

Real financial data

Users can evaluate real services through our comparison tools

Accessibility first

Financial education needs to be available to those who need it most

Money transfer

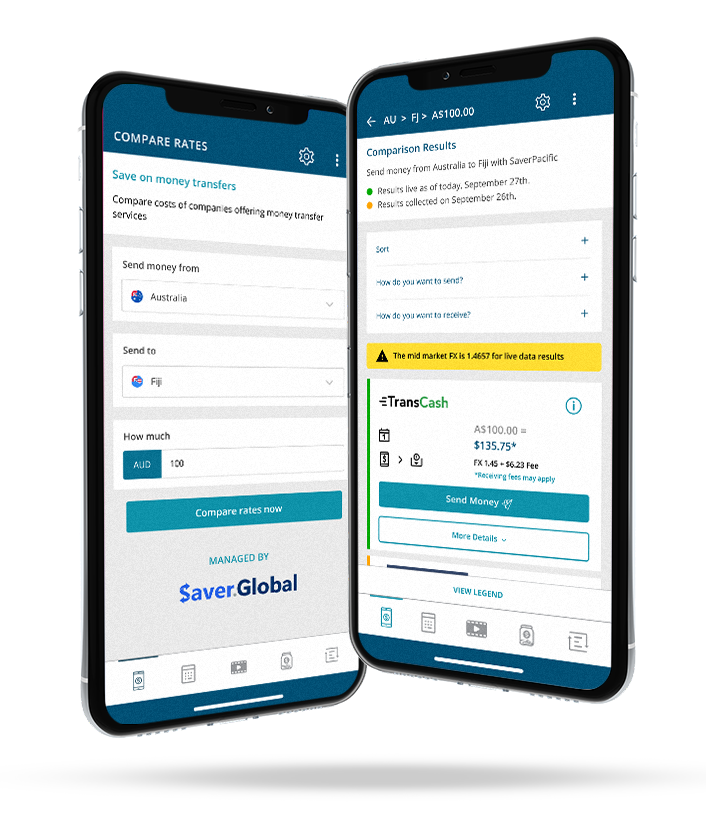

Comparison service

The website promotes transparency by tabulating information about exchange rates in relation to a midmarket rate, encouraging migrants to compare the exchange rates to find the best individual deal. The filters allow migrants to customise their results, including choices to search by fee price, speed of transfer and method of transfer.

Digital remittances currently command a smaller market share than traditional cash/agent focused remittance services, keeping prices high. Promoting the uptake of digital remittance transfers, by comparing services, helps migrants identify the best ways to send money home.

Financial empowerment

Tools and resources

Learning management system

Personalised financial literacy courses that engage people with Saver platforms, tools and resources.

- App based learning

- Engaging content

- Country specific information and resources

This provides an opportunity to partner with financial services or development agencies to develop courses that build financial inclusion in the migrant community

Basic financial literacy information

- Information and recent developments relating to finance and/or migrant workers.

- ‘How-to’ guides that give people confidence to send money, receive money, open a bank account etc.

- Short articles with financial literacy tips

Development of tools

SaverGlobal designs tools for the migrant community in partnership with organisations and governments.

- Budget calculator with the ability to monitor progress through push notifications.

- Malaysian overtime calculator that has been developed in partnership with the International Labour Organisation Malaysia to support migrant workers working extra hours without compensation.

Opportunities for governments / donors

Custom learning management software

- Opportunity to build and scale education platforms and financial literacy courses for partners.

Live pricing data

From onboarding Money Transfer Operators (MTOs)

De-Risking

By providing a lifeline for MTOs impacted

Supporting Services

That are trusted, competitive and digital service

Custom API

To onboard and offer compliance support

Cutting edge fintech

From integration into the market

saverglobal.com

Data and Reporting

Real time

Custom Access

Facilitation

Real time

Live remittance data

Live (real-time) remittance cost and service data is at the heart of our platforms.

Custom Access

Through a dedicated portal

Custom access for governments, international donors and central banks, and remittances industry through a dedicated portal – providing live country, regional and continent-wide remittance pricing, service and network data.

Facilitation

Open market

Facilitating an open and competitive money transfer market that allows innovation to thrive